Oil prices are getting retarded

-

"The main conclusion of this note is that $120 oil would have profound negative effects on the world economy and global financial markets... Such oil prices would almost certainly precipitate a global recession." ~Robert Wescott April 2006

The PDF of Wescott's original report is here.

The article which looks at his report 2 years after the fact when we have his predicted oil prices is here.

It's comes off as a little heady, but it's a fair retrospective of the report. It DOES point out that Wescott's scenario and the real scenario we are facing today are not identical.QUOTE* the value of the dollar has decreased somewhat so today’s $120 is not as high in comparable terms as Wescott’s

* the rise from $60 to $120 has been a steady climb rather than the abrupt terrorism induced shock and

* we are yet to experience the full year of $120 that the report assumes. -

Oil rises to $131.80 on news that it could rise to $150 by July 4th. Wait... what?

This is getting fucked up.

It also says that Malaysia and some other Asian countries are enacting policies that should curb demand in those countries. So why are we speculating that prices will go up? This is why it should be traded on the free market. It's a fucking positive feedback loop of deathspiral goodness.

(A good reason to think higher capital gains tax is a good idea. If you want the power to fuck shit up this bad, pay for it) -

QUOTE (Gmnotutoo @ May 13 2008, 04:11 PM) <{POST_SNAPBACK}>

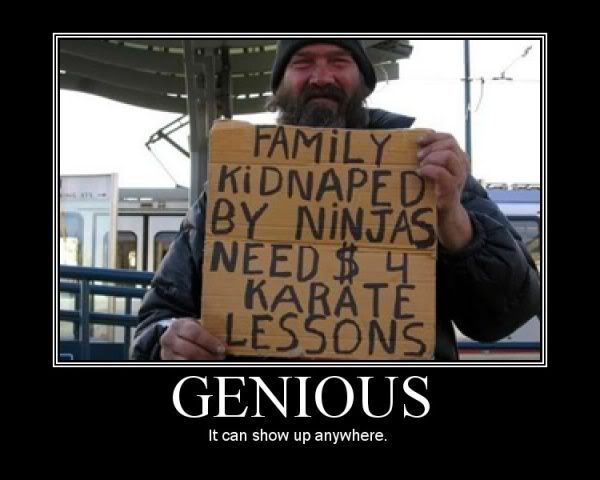

If a homeless person has a funny sign, he hasn't been homeless that long. A real homeless person is too hungry to be funny -

Chris Rock - No Sex (In the champagne room). Epic.

-

$4.44 in california. Obscene

-

-

More news from Saudi Arabia

They plan to up production in July by 200,000 barrels/day. A 2% ish increase. Not bad, but I forsee it doing little to change things.

This discussion has been closed.

← All Discussions Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!